A lost Opportunity: Impactful Wildfire Model Variables That are Rarely Leveraged

Wildfire risk is more serious than ever.

Recent years have highlighted the large loss potential, and because of this, two major model vendors have taken note with major updates to their wildfire models.

For insurers, this can mean a major shift in estimated losses, underscoring the need to have a clear and customized risk perspective

Location and surroundings are critical in wildfire modeling.

Factors like defensible space and Firewise USA® community status can make all the difference – which is why accurately representing the location of the risk, and the surrounding environment is of the utmost importance.

Model variables

DEFENSIBLE SPACE

Defensible Space (Distance to Vegetation) captures the buffer area between a structure and nearby vegetation. A larger distance to nearby “fuel” can help reduce fire intensity and slow its spread.

FIREWISE USA® STATUS

The Firewise USA® program, run by the National Fire Protection Association (NFPA), designates communities that have taken proactive measures to reduce wildfire risk. For a neighborhood to achieve this designation, it must meet strict criteria, including community-wide risk assessments and investments in fire protection. While mitigation efforts on an individual property can help, wildfires, more than other perils, are reliant on the efforts of entire neighborhoods and communities.

Yet, few carriers currently leverage these insights.

Despite the significant impact of these two factors, very few carriers implement them in their portfolio risk assessments. This is unfortunate because capturing these factors only provides a benefit when modeling risks in two major model vendors. Without these details, the base assumptions are that there is no defensible space and that the risk is not in a Firewise USA® community.

Juniper fills this gap.

We’ve teamed up with CAPE® Analytics to enhance client data with key wildfire risk characteristics, like defensible space and Firewise status.

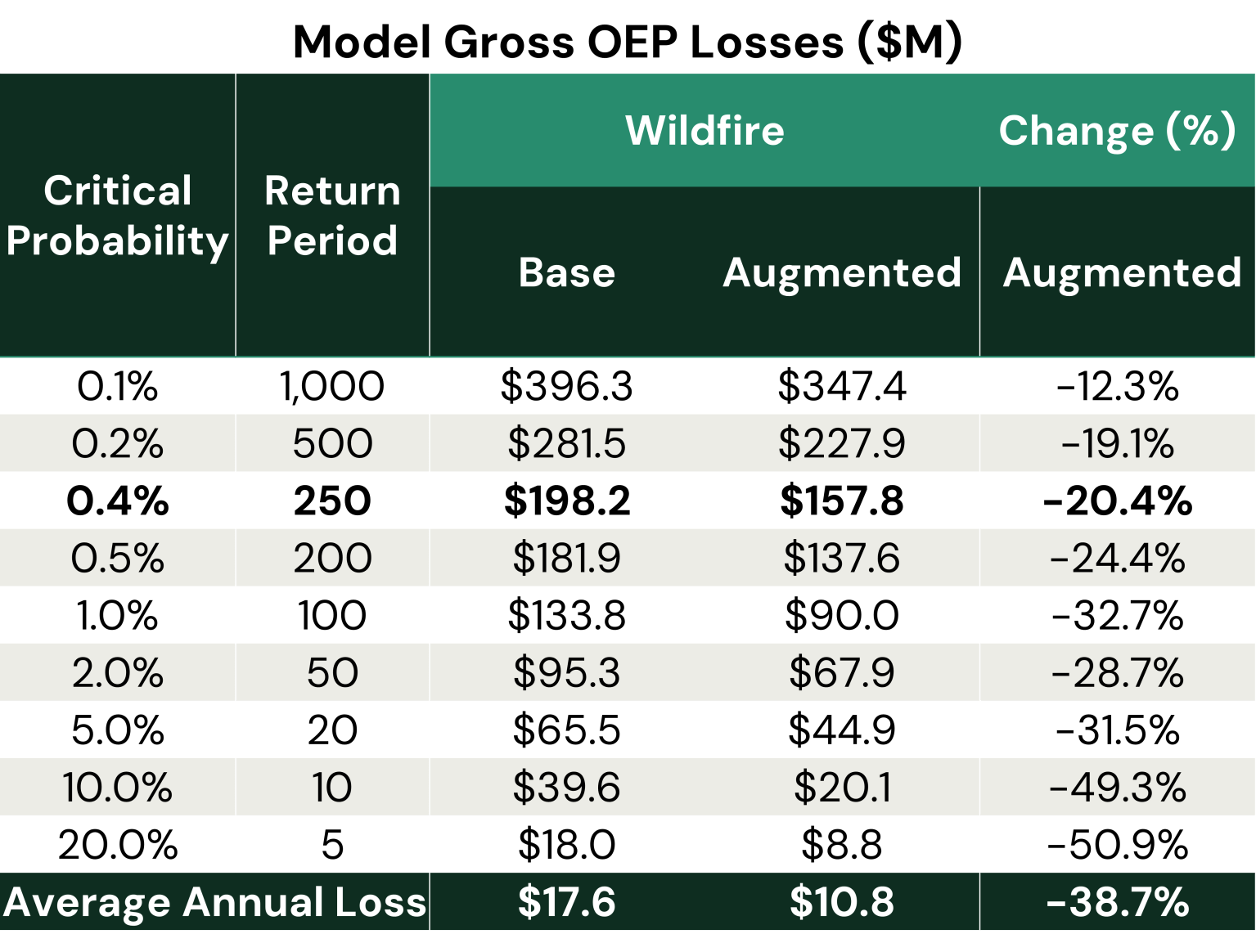

Below shows the impact on modeling results for a sample California portfolio when implementing both factors. Drastic changes in losses highlight the impact these variables can have on a portfolio.

In addition to a more accurate view of loss potential, having a sense of loss reduction and reinsurance cost savings with better data can facilitate more proactive and robust underwriting.

Want to learn more about wildfire models and the impact accurate features can have on your portfolio?

Contact Information

Adam Miron

Head of Catastrophe Analytics, Juniper Re

763.350.8292

JUNIPER RE PRESS

Amy Money, Head of Marketing

Juniper Re

214.533.3837